How blockchain will save the Creator Economy

Why NFTs, DAOs and Open Finance will change the world for artists and their communities.

Creators are Innovators

Creative industries have always led innovation because they’re fundamentally exploratory and hungry for ways to help create sustainably.

Hip Hop, for example, pushed the envelope in almost every possible way during its ascent from the streets to becoming the dominant form of music in the world. DJ Kool Herc, its commonly acknowledged progenitor, birthed a new art form when he extended dance-friendly breaks by combining multiple records across turntables in the ‘70s and others in the industry have driven innovation ever since.

Just like that first technological experimentation to make better dance parties in the Bronx started a revolution in music production, today we’re seeing the emergence of a new set of tools with the same power to enable artists to engage their fans and change the world.

In this post, I’ll walk through some of the problems that creators and communities face today and how a new blockchain-enabled toolkit will make them more aligned, engaged and sustainable.

The Creator Economy

The advent of the Internet in the late ’90s ushered in an era where people around the world could both create and consume much more easily than ever before. You can do more with a Macbook today than a whole studio could 20 years ago.

It also became substantially easier to find communities of common interest regardless of geography, and a larger portion of all our lives migrated into the digital realm. New hardware and software tools made it much easier to produce content — whether multi-platinum albums or simply micro-niche blog posts — while the web’s scale made it much easier to distribute this content.

Unfortunately, the boom in creation and the massive expansion of platforms to support large fanbases wasn’t matched by a similar boom in the sustainability of creators. In fact, while the increased size of audiences allowed top creators to reach a grander scale, the infinite replication of content and the power of distributors as middlemen made it more difficult for most other creators to benefit from their intellectual property (“IP”).

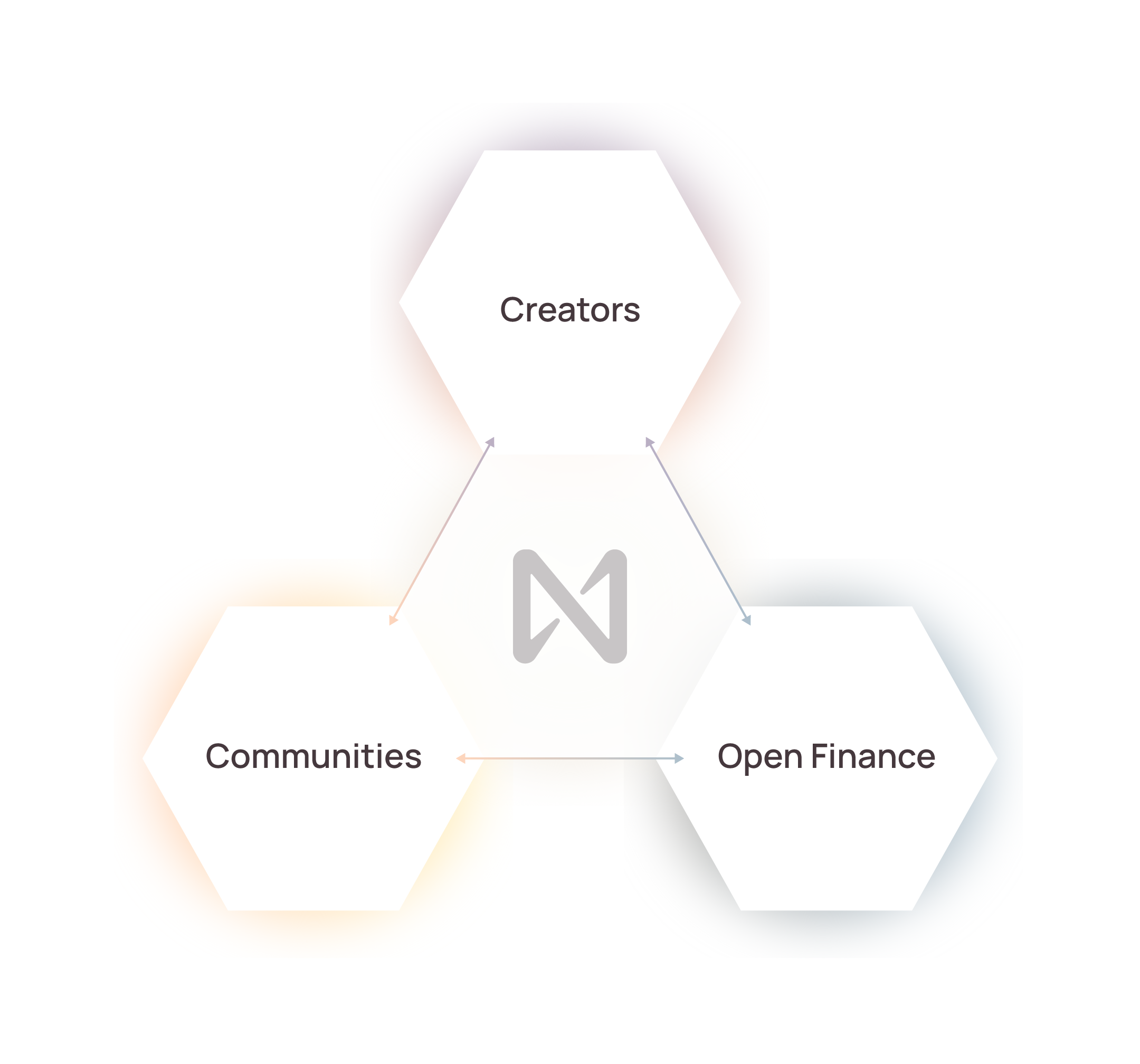

The relationship between creators and their communities drives the so-called Creator Economy, which is a dynamic between 3 factors:

- Creators who produce something of value

- Communities who support these creators

- Financial tools and platforms to help make creators and their communities sustainable

The line between creators and communities can be blurry, for example when users generate content, but ultimately someone has to pay for something in order to create a sustainable economy.

Today, this economy is generally a one-way path where the creator produces something (eg an album), gets fans to consume it (typically losing most of the proceeds to the middlemen who control their relationship with fans) and tries to earn real income from secondary revenue streams like concerts or merchandise or sponsorships. This system is rife with problems and it’s only sustainable for creators with enormous or highly engaged fan bases, particularly if they’ve given away their IP rights along the way. This leaves the so-called “long tail” of smaller creators underserved and makes things tough even for the larger ones due to all the middlemen who have their hands in the pie.

What’s Changing Today

So how do we make the creator economy more sustainable for everyone?

It requires improving the underlying technology of the web to unlock new tools for both creators and their communities to build stronger, more sustainable bonds. Specifically, it means merging the technological revolution which started with Bitcoin in 2008 with today’s Internet to create new tools like NFTs, DAOs, Fungible Tokens and Open Finance (“defi”).

Here’s how it all fits together.

If you go back to the Creator Economy Triangle from before, each corner has needs that weren’t met before:

- Creators haven’t been able to sustainably benefit from their IP because of the commodification of content in the digital world which devalues their creativity and which leaves them at the mercy of their distribution partners and the platforms holding their fanbases.

- Communities haven’t been able to effectively self-organize outside of existing social platforms, make themselves sustainable or align their interests with those of the creators they support.

- Financial tooling has limited the economy itself to one-time or recurring payments for goods or services because the tooling has been anchored in a world of bank accounts and Paypal-like providers. Royalty schemes and payments are also notoriously arcane, inconsistent and exploitative to creators.

In 2021, blockchain technology has finally arrived at the point where it can solve all three of these issues and unblock the Creator Economy.

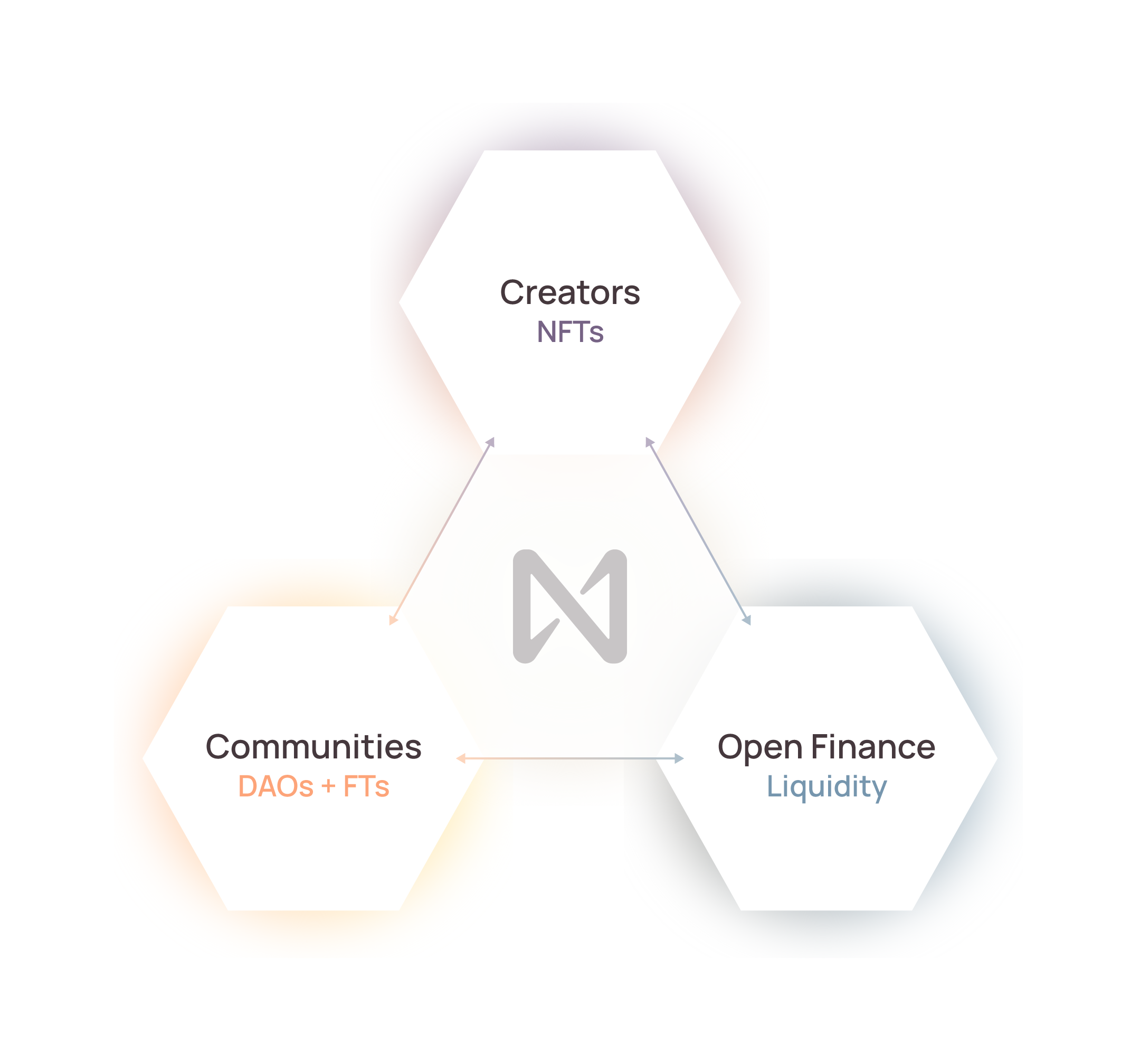

This is because each of the key aspects of the Creator Economy is served by a specific set of tools which weren’t possible to combine like this before a platform like NEAR was available. This gives us a new Creator Economy Triangle, which shows how these tools — NFTs, DAOs, Fungible Tokens and Open Finance (“defi”) — interact:

At a high level, it breaks down like this:

- NFTs are basically digital containers which can hold IP but which liberated it to be owned and traded so creators have a world of new ways to produce, distribute, remix and monetize content.

- DAOs are basically like shared bank accounts for communities which are entirely digital so it’s really easy for communities to act almost like official co-ops or companies and build sustainable models for themselves. They can issue fungible tokens which are basically membership cards with a lot more potential superpowers to drive more engagement.

- Open (“decentralized”) Finance is a whole toolkit which allows creators, communities, NFTs, DAOs, fungible tokens and all the other pieces of the digital economy to plug into each other in ways that no one has ever done before, allowing entirely new ways of earning income for creators or benefitting from the upside of membership for community members.

Let’s look a little deeper into each of these pieces and why they’re so powerful to help creators.

NFTs: Tools for Creators

NFTs are understandably confusing for many people, so I’ll break it down in plain English.

The most important concept in NFTs is that, after decades of infinitely sharing creative output on the Internet, we finally have digital scarcity. That means that we can finally prove that a particular file or piece of content or piece of data is uniquely owned by a single person.

All digital tokens, including NFTs, are based on the same principle as Bitcoin because it uses the same type of technology — “blockchain.” What the creator of Bitcoin figured out is that, if we create a globally shared ledger that records the owner of every single bitcoin in the world, we can always know exactly how many Bitcoin there are in the world and make sure no one is spending them twice.

If you ever hosted a website on Geocities back in the day and watched it get lost forever because their platform shut down, you understand the value of protecting your important assets from deletion. What Bitcoin figured out is that you can essentially share the hosting of this ledger among thousands of people around the world so, unlike Geocities, it can never get deleted just because one of them got shut down.

So, fundamentally, an NFT is just like a Bitcoin — it’s a unique piece of data that everyone in the world agrees is owned by, say, Joe Smith because thousands of people are running the NEAR network together and agree on it. What’s different is that NFTs are much more advanced than Bitcoins.

A bitcoin is really pretty boring — I can show you that I own one, I can send it to my friend to pay for something and I can do a few more simple operations with it. An NFT, because it’s built on a much more advanced network, is basically an empty container that can hold any type of data AND you can program it to do anything just like software.

Why NFTs are so powerful

Here’s why that’s so useful for artists, using a simple example. Let’s say an artist has created a piece of digital artwork. In today’s world, those rights are usually stored in the server of some record label somewhere and backed up by a paper signature on some lawyer’s document or, if the creator is independent, it’s at least protected by copyright law so the artist just owns it. Every time the artist allows someone to use it (officially), they or their manager have to explicitly allow it to happen with some sort of signature, which really slows things down and limits how it can be used.

If the artist assigns the IP rights to an NFT, that NFT becomes like a bearer-bond because whoever holds it can now use the legal right. In the simplest case, that person can display it on their digital wall just like a piece of art in the real world and they can know that it’s truly *theirs* to display. But, unlike a painting in the real world which can be bought or sold in a smoke-filled room somewhere and the artist never knows, NFTs are digital objects that can be programmed to do anything and you can always know where they are.

In the physical world, the artist makes revenue from selling an original edition and maybe the rights to produce more. When these things are resold, the artist never knows about it and never earns any income from it. Because NFTs are digital objects that live on the NEAR blockchain, every time they are bought and sold, the artist can be notified and paid a commission. Every time, in every location. Not just that, but the NFT can be programmed to permanently split that revenue however you want — maybe 10% goes to the artist, 5% to the agency which helped create it, 4% to the artist’s union and 1% to a charity they support. Maybe 5% gets split among everyone who previously owned this NFT so they are incentivized to help it retain value. Anything is possible.

That’s not even the best part.

Because NFTs can send cash back to the artist automatically when they’re traded, they can be traded anywhere. Before today, digital items were stuck in centralized marketplaces because that was the only way that companies could pull revenue from their resales. For example, digital skins which are created and traded in the Fortnite ecosystem need to be purchased on Fortnite’s proprietary platform so they can get their cut. But now that the NFT itself will always send the money back home, it can be traded anywhere and the artist or original IP holder will always get paid.

Let me ask you — back when you were a kid and traded collectibles, did you do so on some official company marketplace or unofficially among your friends? Exactly. Now, everyone from artists to big IP-holding companies are incentivized to set their NFTs free so people can trade them anywhere in the world. Suddenly, everyone’s interests are aligned to set the art free! This will result in orders of magnitude more transactions. More trading.

Because NFTs are infinitely programmable, we don’t even know yet all the cool ways they can be used. It’s possible to use NFTs as membership cards which give people access to special events. The artwork becomes more than just a thing to display or a cash flow, they become a special designation of status that the artist or anyone else can use to give special privileges to the holder of. What else might be possible?

DAOs and FTs: Tools for Communities

A “DAO” is a decentralized autonomous organization–– which uses an admittedly clunky acronym to represent a formalized community that can self-govern and take on some aspects of a company.

Everyone who uses the blockchain gets a NEAR account. It’s sort of like a Facebook or Google or bank account except that, just like NFTs, it’s permanent because it lives on NEAR’s “forever network” and it’s not associated with any particular company. It’s 100% yours and you can call it whatever you want – for example by naming it after your Twitter or Insta handle (I see you `machoman99`). This account can store your tokens, your NFTs or pretty much anything else you do on the platform.

A DAO is basically just a more advanced account which can be shared between a group of people. In this way, it’s similar to a bank account but it doesn’t actually need a bank.

Why DAOs are so powerful

DAOs are useful because they can do anything an individual user can but they can also represent all of the users who are their members. In the simplest example, you can store a bunch of tokens in a DAO and the group of users in the community can vote to send them to different places. Let’s use the example of a fanclub DAO we’ll call `dj_blokk_fanclub`, where fans of that artist pool funds to buy VIP tickets for a show and raffle them off. Because the community exists on a permanent platform like NEAR, it isn’t lost if Facebook or Snap suddenly become less popular.

This example is simple but bear with me. Just like NFTs, DAOs are a basic tool that quickly gets extremely powerful.

For example, a community can issue a token (it’s called a “Fungible Token” aka “FT”) and use that token to determine what kind of privileges their members get. For example, let’s say our DAO issues 10,000 `$BLOKK` tokens to split among the fanclub’s early members and then automatically creates another 10,000 each year that can be distributed to new members, really helpful members who help the group govern itself, or people who refer new members. And let’s say members need to hold 10 `$BLOKK` tokens to join the VIP Discord server. This incentivizes community members to be extra engaged and helpful.

Or maybe the community’s DAO issues the same 10,000 `$BLOKK` tokens but gives 1,000 to the actual DJ Blokk in appreciation and DJ Blokk gives special VIP show access to anyone who holds more than 100 `$BLOKK` tokens. This is important because now the creator and the community are beginning to directly align themselves. And the token suddenly has value as well.

Finally, it gets magical when we combine the DAO with NFTs. Let’s say DJ Blokk is putting together a new single and wants to fund it from within the community. The artist can sell `$BLOKK` tokens and, in exchange, issue an NFT that sends some of its royalty stream back to the community’s DAO.

Suddenly, you’ve unlocked:

- A way for communities to be platform independent and distribute funds

- A crowdfunding mechanism for artists

- A way for community members to be financially aligned with making the artists they support successful, creating extremely high engagement and virality.

As with NFTs, we still don’t know all the ways you can use DAOs to support creators and communities but just these few are enough to break existing industry models.

Decentralized Finance: Making it Sustainable

Creators usually only think about payments when they’re broken. “Can people in [insert country] buy my merch? Great.” As a quick review, we’ve already introduced some new NEAR-powerd financial tools —

- NFTs can be programmed to send royalties anywhere when they are traded

- DAOs give communities the ability to send payments and issue tokens without a traditional bank account

As before, let’s explore what’s possible by building up from the simple stuff.

For starters, our creator’s NFTs or our community’s `$BLOKK` token need to be bought and sold somehow. Consumers need to easily click an Instagram link to purchase the initial NFT, buy it on a marketplace somewhere or get their hands on `$BLOKK` tokens so they can get in the VIP club. This is all straightforward stuff that can be done with familiar credit card processing on NEAR.

Things get more interesting when you consider what people might do when they are holding their new NFT or `$BLOKK` token in their accounts. Before today, if I bought a collectible online or received it for attending a concert, it would just sit in my account on that one single platform or scattered across multiple independent platforms which don’t communicate with each other.

Today, getting those collectibles is just the beginning. For example, a community of fans may decide to set up a DAO for themselves which purchases very rare NFTs. These NFTs can then be used as collateral in automated lending platforms to borrow more money to participate in future sales that might only be open to the holders of those NFTs. The community DAO could even issue their own tokens so small pieces of the portfolio can be easily traded and people around the world can participate. All of this is part of a stable, global financial system which has previously only been accessible to the wealthier countries.

Essentially, assets that were created in the digital world have access to the entire suite of sophisticated financial tools that historically were only available to wealthy investors. Because of this, there are markets around the world for each of these tokens and NFTs which makes them much more liquid and thus more desirable to hold. It’s hard to sell a Picasso, but much easier to sell tiny portions of NFTs from the DAO above.

More simply, holders of these collectibles can buy, sell, trade or combine them with others to access real world benefits, play in digital games, or otherwise engage more deeply with their creators.

If you’re lost in the financial language, the key takeaway is this — NFTs issued by artists typically benefit most when they are frequently traded and the new decentralized financial toolkit makes this extremely easy compared to the way it works in the traditional world.

But, as with NFTs and DAOs, we still haven’t even figured out all the ways this technology can be used. Luckily, it’s easier to remix these tools than it ever has been. A developer in a single weekend can now build sophisticated financial products that securely handle these assets and their cash flows, which normally would take a team of developers with millions of dollars in venture capital months to put together. This means that the speed of innovation is finally moving at the pace of creativity so artists can get directly involved in the creation, building, remixing and experimentation of new tools that produce new art, engage fans and generate novel revenue streams.

Tying it all Together

Where are we now and where is the ball going?

While blockchains have been around since Bitcoin arrived in 2008 and many of the core ideas — NFTs, DAOs, Fungible Tokens and Defi — have been in experimentation on Ethereum since 2016, NEAR’s launch late last year was the first time a platform came to life which could make these tools accessible to everyday creators, communities and fans.

A lot of the financial tooling of Defi was built and tested on Ethereum, particularly during mid-2020, but remains prohibitively expensive and complicated for most people to use.

NFTs had a moment in late 2020 and early 2021 when a bunch of artists started making eye-popping sales and big companies started playing with gamification but these experiences were incomplete because they either couldn’t be accessed by everyday people due to cost and and usability concerns or they were part of wholly owned “walled gardens” which leave the assets isolated.

DAOs are just starting to pick up momentum because, until now, there hasn’t been a way to make them useful to consumers due to cost and usability concerns. Now that this final piece has been solved on NEAR, DAOs will finally be able to serve communities as they were meant to.

So, the tech has finally arrived to use these tools but we’re still in the explore-and-mix phase. It’s like the first time DJ Kool Herc kept that break beat going between two records — we just had the major “aha!” moment and now it’s up to the creators and communities of the world to take these tools and get this party started.

…and, if you’re ready to do so, reach out!

For creators or IP holders with massive fanbases, reach out to [email protected] to see how this can be transformed into an engaging, repeated revenue stream. For community leaders interested in upleveling their community engagement and sustainability, reach out to [email protected]. Finally, if you’re a developer who wants to hack on this stuff, check out https://docs.near.org and the free 5-day bootcamp at https://learnnear.club/certified-near-developer-application/.

Share this:

Join the community:

Follow NEAR:

More posts from our blog